Amazon India is one of the largest eCommerce marketplaces Globally and now also in India. Amazon provides a platform to bring buyers and sellers together. Sellers can register on Amazon and can start selling on Amazon in simple steps through Amazon Seller India.

Once Sellers lists their products on Amazon, they will start getting orders from the buyers. Amazon collects payments directly from buyers and settles them periodically as per a predefined Payment Cycle.

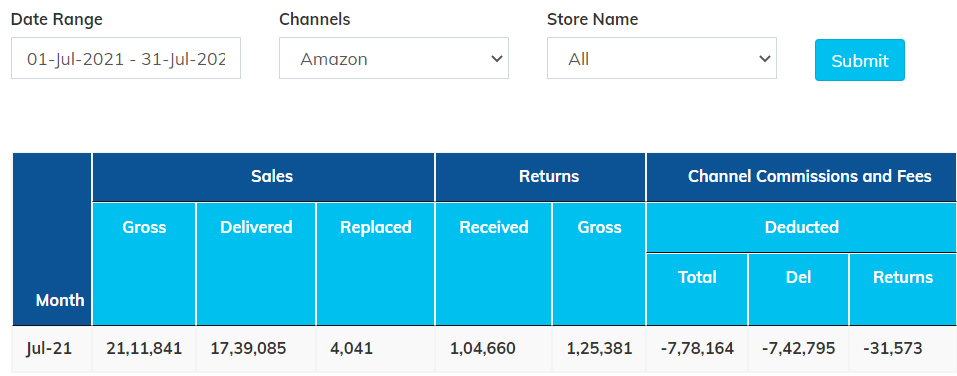

Amazon also deducts various types of commissions, fees, and charges from sellers known as amazon commision rates to manage the various costs like shipping costs, payment costs, packing and storage costs etc.

A simple example to illustrate this is below:

- A seller sells a pair of shoes worth Rs. 500/-

- Amazon levies the following costs on the sale: 12% commission (Marketplace Fee), Rs. 50/- as shipping costs, Rs. 20/- as Fixed Fee, Rs. 15/- as packaging charges. Alongside, Amazon also deducts a TCS (Tax Collected at Source) of 1% on the selling price (excluding GST)

- Let’s total this up: 60 + 50 + 20 +15 + 5 = Rs. 150/-

- Hence, Amazon will settle an amount of Rs. (500-150) = Rs. 350/- to the Sellers Bank Account.

However, payments are not settled for individual orders. They are cumulatively settled for orders fulfilled over a period of time. This is known as a Payment Cycle. Payment cycles may vary from time to time. An example of a payment cycle is:

- Orders from 1st to 10th of a calendar month => Settlement on 15th of the same month

- Orders from 11th to 20th of a calendar month => Settlement on 25th of the same month

- Orders from 21st to 30th or 31st of a calendar month => Settlement on 5th of the next month

Why is it important to organize the reports by month?

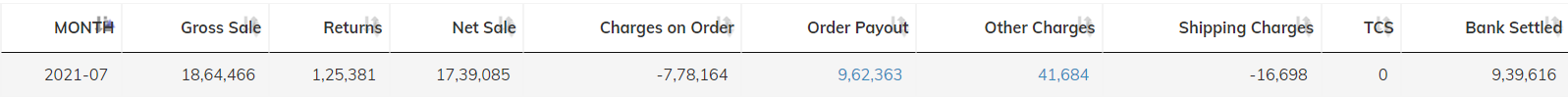

eVanik Reco Plus syncs your Amazon data reports and sorts them as per the preset algorithms into different smaller tables, helping to prevent skews in your sale numbers.

By working through these tables, it matches the low-level transaction amounts to what Amazon considers high-level transaction categories in their settlement report.

Our general advice is not to necessarily use the same grouping that Amazon does in your financial reports.

However, it is also important to note that Amazon also deducts the value of Customer Returns or Courier Returns from the overall Delivered/Shipped Orders when making the payment. Since, few of the returns are in transit and therefore, the status is not available, Amazon will hold back a calculated amount to cover the forthcoming returns. This amount is called the “Reserve Amount”. When making the settlement as per the Payment Cycle, Amazon also deducts the reserve amount which gets subsequently settled in the next payment cycle on receipt of the returns that were earlier in transit.

Amazon also provides the facility of advertising to sellers. Sellers can choose to promote their products on the Amazon platform by opting in for promotional events such as:

- Lightning Deals

- Coupons

- Sponsored Ads

For events such as the above, there are additional fees and charges. At the time of making the payments against the net delivered orders to the sellers, Amazon also deducts the charges against these events.

Best Reconciliation Practice:

eVanik’s learnings from over 13,000 Sellers since 2016 has helped us in defining the best recommendations for reconciliation of your Amazon Marketplace Account: Here’s a summary of how one must do a basic payments reconciliation for Amazon Business:

- Sign in to your Seller Central Account.

- Download your MTR (Merchant Tax Report), Date Range Settlement Report for the period that you would want to do the reconciliation. It’s advisable to add 15 days in the Date Range Settlement Report when doing the reconciliation match

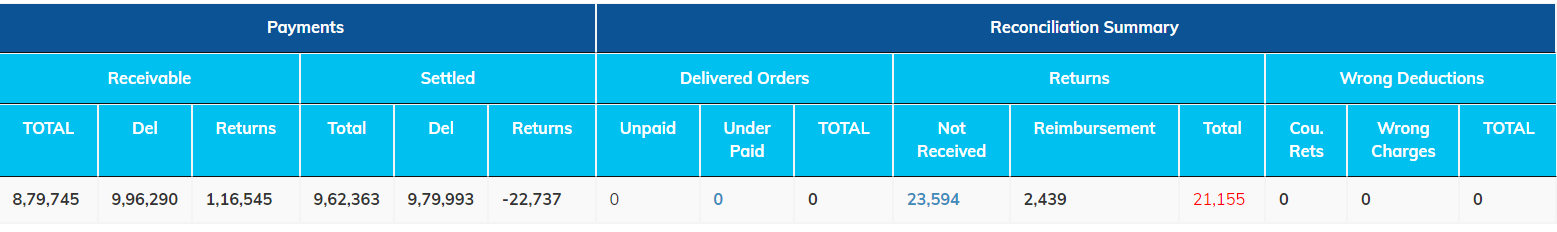

- Match line by line item on the MTR report with the Settlement Report. In accounting terms, this process is typically referred to as matching account receivable (A/R) (created at the time of fulfillment), with undisbursed payment (in your seller payable account). When completed, all increases to accounts receivables (delivered orders or sales) will be matched to undisbursed payment in your seller payable account. This feature is known as Payment Reconciliation.

- When you identify any line item in the sales report that does not have a corresponding payment match, highlight that row with a noticeable color. There could be many reasons why that particular Order ID will be showing as unsettled, such as return in transit, order canceled, settlement in the next payment cycle, etc.

One must also note that spreadsheets have their own challenges, which may increase the gap in your reconciliation activity. Following are the challenges when using spreadsheets or manual systems in the reconciliation process:

- Dynamic nature of eCommerce business. Assume that your downloaded sheet has few orders today showing order status as delivered and we start reconciling as per that. However, the next day, few of those orders moved into returned or canceled status. Effectively, we would end up working on wrong data expecting to get the right results

- For sellers having huge order volumes, spreadsheets may take a long time to process the information especially if there are multiple sheets having formulae, etc.

- Reconciliation on spreadsheets cannot be on a real-time basis, as the commission/fee structure keeps varying from time to time.

Procedure To Reconcile Amazon Settlement Deposit

Here is the step-by-step procedure to get the reconciling done for the Amazon settlement deposits.

- Step 1: Wait For The Settlement Deposit

As stated above, Amazon pays the sellers every two weeks. So, wait for the settlement deposit, after which you can go ahead with the process of reconciling. Most of the suppliers or business owners integrate their bank accounts with the accounting system of Amazon to start the process right away. - Step 2: Get The Amazon Settlement Report

Find the reports section under your seller dashboard and go to payments to view your settlement report. Select the report that you want to reconcile, then save the statement as a PDF. - Step 3: Determine The Gross Settlement Deposit

Firstly you need to make sure that you have added all the accounts onto the accounting system of Amazon to continue with the reconciling process. You cannot continue with this process if you have not done it yet. - Step 4: Check The Income Statement

After you have broken down the costs and income in the system, check on the income statement for the results. You can check your income statement in Xero. Check for the right format along with the placement of amounts appropriately.

These are the steps that you need to follow for reconciling Amazon Seller payments. You need to understand the process well as for big businesses that involve a lot of sales, deposits, or expenses, the process becomes a bit complex. So, get well versed and implement the steps accordingly.

Look for the deposited amount information in Zero and click on Add Details. After this, you can start to enter the accounts along with the respective amounts. While doing this, you need to make sure that the total amount equals your net deposit. The main aim of the sellers here must be to add the revenue amounts to the related costs for making the total amount equal to the net deposited amount. Once you are done with that, you can save the transaction.

Hence, it is important to have an automated tool that keeps updating your Amazon reconciliation data on a real-time basis and provides you with instant Amazon reconciliation reports that can also be filed for claiming the gaps from Amazon.

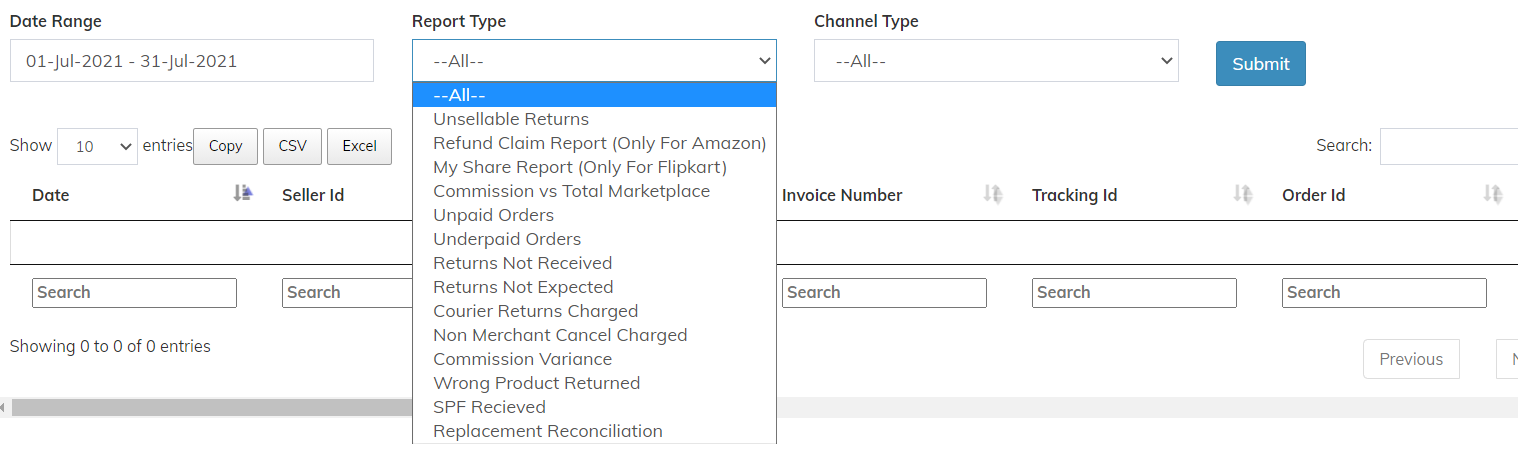

eVanik, as an Amazon Reconciliation Tool provides 14 plus R2R (Ready to Reconcile) reports

Alongside there is also an amazon reconciliation dashboard that summarizes periodic payment reconciliation reports, cash flow statements, and lots more.