Understanding Marketplace Reconciliation for Online Sellers

we at eVanik felt the need for complete guide on marketplace reconciliation for all E-commerce sellers. This article will make you understand all the stages where there is revenue leakage and what parameters you should keep in consideration for marketplace reconciliation

Let’s start with the general definition of “Reconciliation” or “Account Reconciliation”.

Account Reconciliation is the process of comparing internal financial records against monthly statements from external sources—such as a bank, credit card company, or a supplier/vendor/customer other financial institution—to make sure they tally with each other.

In our discussion, the external source is an e-commerce marketplace such as Amazon, Flipkart, Snapdeal, PayTM etc.

In every business, reconciliation of accounts is essential to maintain the financial health of the company, detect frauds, errors and discrepancies and ensure long term sustenance and profitability of the company. Using a software like eVanik OneWorld Suite to reconcile your marketplace business does most of the work for you and saves over 99% of time for you, but there is still that bit of human intuition and intelligence required to make the reconciliation process fool-proof.

Many e-commerce sellers are unable to complete the marketplace reconciliation process in a timely and accurate manner, which introduces risks, leakages and losses and eventually winding up of business. Sellers that adopt a more automated and continuous reconciliation approach benefit from a more controlled and preventive environment and reduced risk of misstatement.

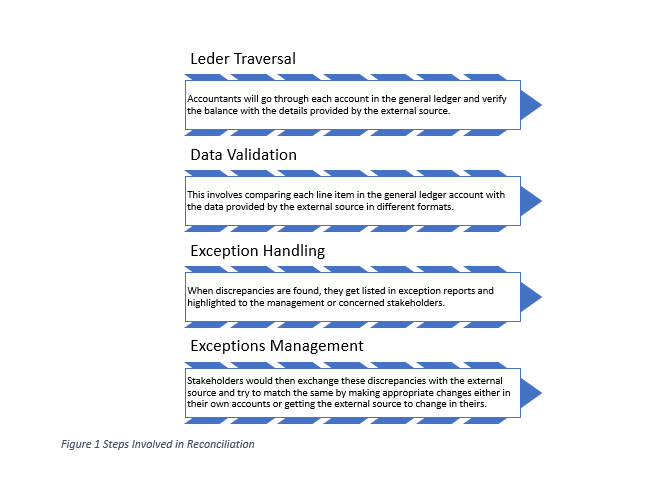

To understand the marketplace reconciliation process in detail, we will first list down the basic steps involved in the reconciliation in a traditional business environment.

Now let’s expand the above by understanding the transactional complexities involved in marketplace business. Let us quick understand the business process flow vs the reconciliation process / challenge involved.

| Business Process | Parameters | Reconciliation Challenges |

| Buyer Order Status | Multiple stages like pending, approved, packed, ready, shipped, delivered, returned | Dynamic statuses get updated regularly thereby making it impossible to track on downloaded spreadsheets |

| Marketplace Payment Cycle | Orders get cumulated for a time period and get collectively paid | Aggregated payment cycle involve deductions and reserve amount held up to cover future possible returns from customers |

| Commissions & Marketplace Fee | Marketplaces deduct commission charges on all orders | Commissions vary basis category, event based seasonality, tier/level of seller, fulfilment model etc. Actual vs Applicable charges |

| Shipping | Shipping charges levied by marketplaces for delivering orders | Shipping charges calculated basis weight type (dead weight vs volumetric), distance (Local, Zonal, National) and charged twice in case of customer returns |

| Returns | Orders returned either by buyers or by shipping providers and Replacements | Return Status (Received or Not), Damaged or Sellable, courier or customer return |

| Claims | Marketplaces reimburse some amount to sellers against loss or damage caused due to customer / courier or at the Marketplace Warehouse | Check claim eligibility, claimed on time (Claim Window), right amount claimed, claim reimbursement status, right amount reimbursed |

| Cancellations | Orders can get cancelled by Buyer, Marketplace or Seller at any stage of the order | Orders which are not cancelled by the seller may attract a penalty which may need to be claimed back |

| Other Charges | Marketplaces levy other charges like Fixed Fee, Closing Fee, Packing Fee, Storage Fee and many more. | Multiple heads of charges against every order level for thousands of orders across multiple marketplace channels, products and categories is virtually impossible to keep track of. |

| Payment Settlement | Marketplaces pay after keeping themselves covered and deducting the applicable charges and holding a reserve amount. | Bulk settlement invites reconciling every single order under various cost heads. Manually doing this will involve huge manpower bandwidth and costs and a very long time. |

| Inventory Reconciliation | Fulfilment models like FBA involve storing sellers inventory at the warehouses owned and operated directly by marketplaces. | With no physical ownership and visibility of inventory at FBA type warehouses also involving fast and continuous movement of stocks, it is impossible to keep track of inventory count on a real-time basis. Some marketplaces move the stocks between multiple warehouses and provide a stock statement only once at the end of the month. Inventory also gets damaged, stranded or lost at these warehouses. |

| Others | Other challenges including non-order related costs like advertising fee, storage fee etc | Non-order related fees are deducted from the eligible settlement value and a statement is provided at the end of the month. |

| Accounting | Sales, Returns, Commissions, Payments, Reserves, TCS | Automating accounting entries into the accounting software used by sellers, ensuring that the same is always matched with the reports provided by the marketplaces and being compliant on GST and other Government requirements. |

E-commerce sellers business owners typically spend their maximum time trying to be on top of their reconciliations with marketplace channels.

However, the results are mostly ambiguous and outdated because of the dynamic nature of e-commerce business. Complexities widen when sellers are doing business with multiple marketplaces and have expanded their operations to various branches across multiple locations.

Manual and spreadsheet reconciliations are good in a situation when orders are limited and sellers are operating in a single marketplace and a single location. When the multiplier effect steps in, manual efforts will not just increase costs and inefficiencies, it will also lead to frustration and loss of sale.

Marketplaces also impose penalties based on their policies and subsequent algorithms configured thereof. Some wrong penalties may get unnoticed and the seller could incur unwanted losses on the same.

Keeping the above in mind, it is absolutely essential that one should have a good payment reconciliation software which has established credibility, is time tested and approved by marketplaces themselves. All of these ingredients are available with eVanik OneWorld Suite, which is helping sellers reconcile and recover millions of dollars arising from reconciliation gaps and leakages.

Here’s what you can expect from a good marketplace reconciliation software.

- Transactions related to orders, returns, commissions and payments always updated in your panel 24×7

- Identify wrong charges

- Provide alerts on claim window timelines

- Provide reconciliation reports in the format which can be directly raised as tickets to the marketplaces

- Keep track of your claims with marketplaces

- Micro analyze gaps in every cost component like commission, shipping, pick and pack charges, fixed and closing fee, carrier damaged without reimbursement, replaced orders not reimbursed, customer refund claims and lots more

- The system should incorporate the reconciliation reports in-line with the claim and reimbursement policies of the marketplaces

- Provide profitability statistics at product level incorporating your purchase costs / COGS and GST / Tax rates giving you the true picture so that you can drill down if there are any gaps.

- Estimated receivables vs actual received at order and product level.

- Fully integrated and compliant with all popular accounting software like Tally ERP9, Zoho Books, Alignbooks, FCA Integral, Netsuite, SAP, Navision etc

- Downloadable reports with summary of reports for CXO / Management view. If you are looking for a robust, time-tested and proven marketplace reconciliation and integrated accounting solution for your e-commerce business, look no further. eVanik OneWorld Suite has helped over 12,000 e-commerce companies since 2006 to power-up their performance on marketplaces. To request assitance on Reconciliation Click here to read more.